Hyundai Corporation Chairman Chung Mong-hyuck Stresses the Need for Aggressive Management, Unveiling Plans to Actively Implement M&A Activities

– At HC’s Global Strategy Conference, Chairman Chung Asks for Expanding its M&A Portfolio

– Highly Likely to Acquire an Automobile Parts Manufacturer

– Posting Strong Performances, HC Has Accumulated a Wealth of Cash

– HC Has Recruited a Former Hyundai Motor Company Executive

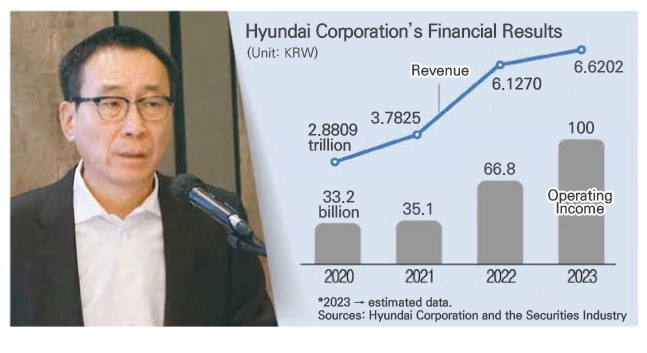

This year, Hyundai Corporation plans to expand its business size via M&As. Last year, it posted an operating income of about KRW 100 billion, the largest figure since it was spun off from the HD Hyundai Group in 2016. A series of strong performances enabled HC to secure a wealth of cash and make bold business decisions. If an M&A deal is signed, the deal will become HC’s first M&A.

According to trading industry sources, at its Global Strategy Conference (GSC), held on January 31, 2024, HC chairman Chung Mong-hyuck said, “We must sign one or more buyout deals this year. I hope that you will make more efforts to build a new portfolio.” A buyout deal refers to an agreement through which a company acquires a 50% or more stake in another firm for the purpose of business control.

The GSC serves as a venue for heads of HC’s 40 or more subsidiaries and branches in the world to gather to devise business strategies for the year. This year, it was held in Four Seasons Hotel in Jongno-gu, Seoul, from January 29-31.

Chairman Chung’s remarks on buyout deals are interpreted as a request to conclude profitable M&A contracts this year. Considering a paradigm shift in global business characterized by bloc formation and regionalization, HC has divided its global business zones where its subsidiaries and branches can actively conduct business activities at their discretion. HC’s global business zones consist of Southeast/Southwest Asia, North America, Africa/the Middle East, Japan, Europe, and the CIS (Commonwealth of Independent States).

Chairman Chung mentioned target businesses as H2 and H3, including all business realms other than the existing trading sector. According to HC’s 3H strategy, H1, H2, and H3 refer to the existing trading business, trading-connected production and distribution, and new projects, respectively.

Automobile-related companies are considered to be potential target businesses. HC has already implemented auto parts manufacturing and semi-knock-down (SKD) projects via joint ventures in every corner of the world. In Kaliningrad, Russia, HC built a plastic injection/painting plant for auto parts while in Bekasi, Indonesia, it established a factory for manufacturing lightweight trunk boards for vehicles. Also, there is an automotive SKD plant in India. Taking into account that HC has successfully promoted the auto business as a new money-making sector, M&A deals are expected to be concluded without difficulties.

In particular, HC recruited a former HMC executive, who is an expert in auto parts, to increase the likelihood of acquiring an auto parts manufacturer. HC’s active business activities are backed by its high level of financial soundness. HC’s consolidated operating income for last year is projected to reach KRW 100 billion. Its operating profit significantly jumped from KRW 33.2 billion in 2020, KRW 35.1 billion in 2021, and to KRW 66.8 billion in 2022. Korea Ratings has recently upgraded HC’s credit rating by one notch to A (stable).

Higher interest rates and global economic recessions are also cited as reasons for HC’s business expansion. With a wealth of cash, HC is able to actively engage in M&A activities. An HC official said, “Higher rates and global economic slowdowns can be regarded as a business crisis but can also provide opportunities for HC to acquire hidden champions suffering from a lack of funds.”

Chairman Chung is well-prepared to set this year as the first year for active M&A activities. Since it was spun off from the HD Hyundai Group in 2016, HC has maintained a prudent business management system. However, this year, it has undergone sudden changes. Chairman Chung emphasized, “Buyout deals are required to raise our operating income by 30% or more YoY. We have to redouble our efforts to achieve our business goals.”

January 31, 2024

Maeil Business Newspaper